Current State of Port Congestion in the Philippines

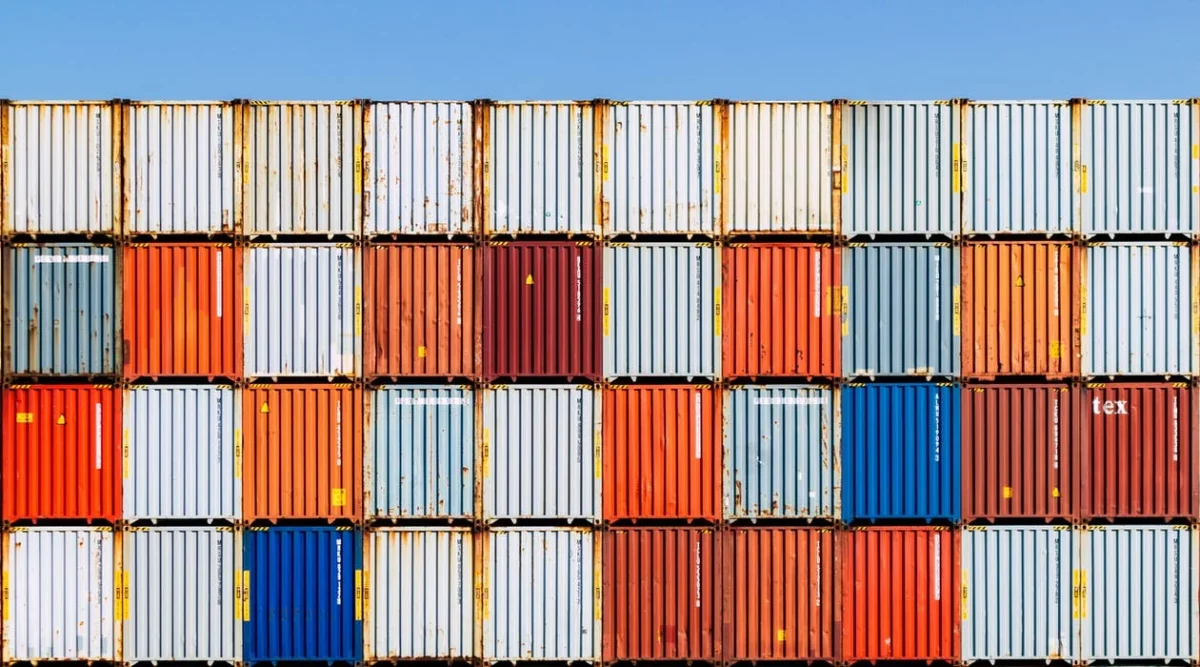

Basically speaking, port congestion refers to the situation wherein a growing number of vessels are starting to queue up outside the port in order to wait for any available space where they can load or offload their cargo. And speaking of the Philippines, maritime-related problems such as port congestion can be quite inevitable, considering the fact that vast oceans and seas geographically surround the country.

Before the advent of their colonizers, the settlers of the Philippines once created wide trading networks within every island that stretches as far as to other neighboring countries like China, Japan, Cambodia, India, Borneo, and the Moluccas.

During the Spanish rule, the trading relations with the said countries continued to flourish, only this time the Philippine capital of Manila has been turned into the center of commerce in the east closing its ports to any countries except Mexico, establishing the what was known as the Manila-Acapulco Trade or the Galleon Trade.

But enough with the history, for this article, will be discussing all about what’s the current situation of the ports here in the Philippines. Intense congestions concerning our harbors can bring detrimental effects for the overall economy of the country in the long run. This is because time is extremely precious for importers, exporters, freight forwarders and other logistics services provider. And with the long delays brought by the port congestion, their operations will surely be disrupted indeed.

How’s the port congestion in the Philippines nowadays?

Based on the most recent news published on various trusted news sites, it seems like there’s some occasional fiasco going on with the government and the Local Truckers Association of the Philippines. This implies that the problem does not lie on the number of the vessels, but on the long queue of trucks waiting inside the terminals. According to PortCalls Asia, the government denied the allegations of any cases of port congestions, for this issue’s roots, can be traced back to a separate problem about by “the high number of empty containers clogging the terminals and this gave the impression of port congestion by the policy of port operators to limit the entry of empty container vans.”

Lest according to the government, the flow of operations within the Philippine ports especially Manila is still within the threshold of being manageable under international standards. As recent as the previous years, they stated that the average dwell time of the ports are seven days, and the utilization level of yards goes in for over 85%. Meanwhile, the quay crane production rate still holds on to 24.84 moves per hour even bearing the international standard of 25.

How this “empty containers” type of port congestion affects the economy?

While there it can be implied that there is nothing to worry about, the congestion of the empty containers in some ports in the Philippines can pose problems like late deliveries of several kinds of goods. It seemed clear that limited space for container yards somehow affects the cost of trucking in the country.

The Conclusion

It can be true that port congestion in the Philippines does exist in a way or two.

However, as stated in the book “Easing Port Congestion and Other Transport and Logistics Issues,” the best way to deal with it is to accept the fact that in most cities like Manila, factors such as port traffic, economy, and human population far outgrows the infrastructures that help connect the ports to nearby provinces that host industrial and commercial estates.

As of now, what we can do now is to trust the government’s figures and hope for the best.

Sources:

- https://www.researchgate.net/profile/Alexis_Fillone/publication/312016706_Easing_Port_Congestion_and_Other_Transport_and_Logistics_Issues/links/586886a908aebf17d3a1965d/Easing-Port-Congestion-and-Other-Transport-and-Logistics-Issues.pdf

- http://nine.cnnphilippines.com/news/2018/11/19/truckers-holiday-protest.html

- https://www.untvweb.com/news/cargo-delaysport-congestion-seen-to-affect-prices-of-goods-this-holiday-season/

- https://help.marinetraffic.com/hc/en-us/articles/115003716171-Port-Congestion-in-the-Port-Details-Page

- https://www.maritimeheritage.org/ports/philippines.html

- http://www.philippine-history.org/galleon-trade.htm