What Are the Factors That Affect Ocean Freight Rates? (Infographic)

During the process of importing-exporting, many companies will decide to hire a licensed Customs Broker to clear goods through customs and ensure all documentation is filled correctly. Customs Brokers are regulated by the Philippine Bureau of Customs (BoC) and are therefore authorized to assist importer-exporters in meeting the rules and regulations governing imports and exports.

However, with the passing of Customs Modernization and Tariff Act (CMTA) in 2016, the BoC has declared that engaging the services of licensed customs broker by an importer or exporter is now optional. According to BoC, the Act provides the importers and exporters with the option to

Since the customs clearing process involves a series of tedious tasks, the latter may not be a viable option for most importer-exporters. This leaves us the question of who is more apt to do the customs clearing process: a customs broker or an attorney in fact?

The Section 102(n) of the CMTA states that term Customs Broker refers to any person who is a bona fide holder of a valid Certificate of Registration/Professional Identification Card issued by the Professional Regulatory Board and Professional Regulation Commission pursuant to Republic Act No. 9280, as amended, otherwise known as the “Customs Brokers Act of 2004”.

According to Investopedia, an Attorney in Fact is a is a person who is authorized to perform business-related transactions on behalf of someone else (the principal, or in this context, the importer/exporter). To become someone’s attorney in fact, a person must have the principal sign a power of attorney document. This document designates the person as an agent, allowing him to perform actions in the principal’s stead.

Overall, a licensed customs broker can provide more specific expertise about customs regulations and laws compared to an attorney in fact. This specialized knowledge very handy especially if you are new in the import-export business.

At Excelsior, we value your business and your time. This is why we want to offer you a customs brokerage service that is efficient, professional, and ethical.

Allow Excelsior Worldwide Freight Logistics Corp. to help you navigate the world of import and export. For any queries that you may have about our customs brokerage service, you may call us at (063) 525-9775, or you can send us an e-mail through wecare@excelsior.ph

If you are just new in the import/export business, then one of the first shipping methods you should get familiar with is the break bulk shipping, better known as Less Container Load (LCL). Probably it is because you are still testing the waters first, i.e., your first orders are likely to be small or, perhaps, your product’s dimensions do not fit or utilize standard shipping containers or cargo bins. Either way, knowing when to use break bulk shipment is essential as you grow your trading business.

In the old-world context, break bulk means the extraction of a portion of the cargo on a ship or the beginning of the unloading process from the ship’s holds.

In the modern context, break bulk is meant to encompass cargo that is transported in bags, boxes, crates, drums, or barrels – or items of extreme length or size. Compared to Full Container Loading, this type of shipping involves paying for space your load takes up in a standard container.

To be considered break bulk, these goods must be loaded individually, not in intermodal containers nor in bulk as with liquids or grains.It is without a doubt the most common form of cargo ever since time immemorial. Examples of commonly shipped break bulk cargo include:

The main advantage of this shipping method is that it allows you to move oversized, over-weight load that would not otherwise fit into a container or cargo bin. It can also be an affordable way to ship large cargo since the item will not have to be dismantled to ship

Take note, however, that even when you are not shipping over-sized cargo, break bulk shipment can still be a very advantageous mode of shipment. If you can find a freight forwarding company that specializes in break bulk, you will be able to control your shipping expense when you are shipping a small trial order.

For exporters, shipping in break bulk requires them to put an extra care in packing and labeling goods because break bulk shipments are more prone to theft and damage. Typically, break bulk cargos are packed using the following materials:

Since the late 1960s, break bulk cargo has declined while containerized cargo has grown significantly. Moving containers on and off a ship are much more efficient than having to move individual goods. This efficiency, therefore allows ships to minimize time in ports and spend more time on the sea.

There are different types of container units that cater to different types and sizes of cargo. The most commonly used by small to medium-sized importers/exporters are the 20-foot container, while large-sized companies often use the 40-foot and 45-foot containers.

The following are approximations of how many pallets or skids can into each type of containers:

Overall, choosing between break bulk and container loading are mainly depends on the type and quantity of your goods.

Allow Excelsior Worldwide Freight Logistics Corp. to help you navigate the world of import and export. For more information on our breakbulk service, visit our website today at www. excelsior.ph. For any queries that you may have, you may call us at (063) 5259775, or send us an e-mail through wecare@excelsior.ph

Your export business would not be successful unless you have a substantial client base that trusts your company. Finding export customers can be a challenging task, especially if you are just starting out or entering a new market. However, with the right knowledge and strategy, you will be able to find export trade customers for your products and keep them as regular customers.

Here are five simple ways to find and acquire foreign buyers for your export business:

Numerous trade shows that cater to different industries are conducted in the Philippines every year. It is a great place to start if you want to expand your business, as well as to keep updated with the latest news in your industry. These trade shows let budding export business owners contact international customers, especially they have a complicated product to offer.

Philippine Embassies have an appointed commercial counselor whom you can request a list of companies that might be a good fit for your products as well as buying agents that are actively looking for suppliers like you. These records are usually made available at no cost, but occasionally you may be asked to pay a fee. The websites of Philippine Embassies also have economy and trade section which posts up-to-date industry analyses and manufacturing reports that may be helpful.

Many people and businesses nowadays use the internet to search for the product they need. To fully maximize the potential of your website, you should include the contact information of your international liaison, if you have, on your contact us page. You should also consider translating your website and marketing materials into the language of the countries you are trying to target. Doing so will make you visible to Internet searches conducted in different languages.

Foreign wholesalers often have their own commissioned agents or middlemen abroad to find and buy great export products on their behalf. Dealing with these local authorized agents can be far more comfortable than dealing with a foreign-based agent as they require less effort to reach and are more motivated since they are paid on commission.

The Business Matching System is a platform created by Department of Trade and Industry which allows exporters to find foreign buyers for their products. It is one of the most efficient ways for an export business operator to meet with pre-screened potential cross-border business associates, whether you are seeking an agent, a distributor or a joint-venture partner. You can take advantage of this service by contacting your nearest Export Marketing Bureau.

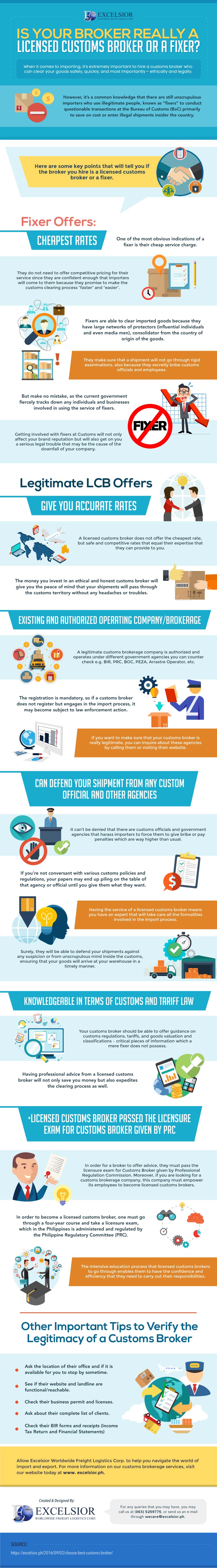

When it comes to importing, it’s extremely important to hire a customs broker who can clear your goods safely, quickly, and most importantly – ethically and legally.

However, it’s a common knowledge that there are still unscrupulous importers who use illegitimate people, known as “fixers” to conduct questionable transactions at the Bureau of Customs (BoC) primarily to save on cost or enter illegal shipments insider the country.

Here are some key points that will tell you if the broker you hire is a licensed customs broker or a fixer.

In our previous post, we’ve discussed the process of clearing your imported goods from the Philippine Customs.

While nobody enjoys getting their freight shipments suspended by customs, it can also result in frustrating and costly delays, especially if the goods awaiting customs clearance are meant to be sold at retail. Not only that but with the possibility of some rather sharp penalties for non-compliance, it’s crucial to follow correct customs procedure at all costs to ensure no additional costs or charges on your cargo.

With that in mind, now that you know the step by step of customs clearing, it’s time for you to learn the ways to fast-track the release of your consignment once it reached the Philippine soil. Here’s how:

1. Have Specific Description of the Cargo in All Documents

Make sure that all necessary import documents are properly filled-out to avoid any delays of you receiving your cargos in a timely manner. By detailed description, it is good to follow your SKU description. If it is a box of red shirts, size medium, indicate that exactly. This will aid the process if an exam is required.

Moreover, you need to mark your goods legibly and conspicuously with the country of origin unless exempted. Exemptions usually apply to goods that cannot be individually marked, like tiny items, such as screws. You should, however, mark the sale packaging of these types of items.

At the bottom of customs invoice, including any markings on the packages, and add a notify party, such as your customs broker.

2. Be Ready for the Import Permit (if necessary)

If you’re an accredited importer, the Bureau of Customs will grant you a special permit in the form of a document which you may need to present during the customs clearing process if you’re a first-time importer. Prepare this, along with other necessary documents to prove that you’re a legitimate importer in the Philippines and to avoid possible legal troubles.

3. Provide Proof of Payment

All goods coming from a foreign country needs to be declared, such as their description, quantity, and their value which will be the basis for assessment of duties and taxes. After the right duties and taxes are paid and registered by the customs authority, you will be provided with a proof of payment which you also need to provide during the customs clearing process.

4. Hire Trustworthy Brokerage Company

Having the wrong person handle your customs brokerage can be very problematic. Shipping containers are warehoused as they go through customs clearance. Warehousing and storage fees can add up quickly. If there is a problem with your customs brokerage and your customs clearance does not happen smoothly, your shipping costs could go up by hundreds to thousands of dollars.

By a hiring legitimate and trustworthy brokerage company, you will be able to experience many advantages – one of such is faster customs clearing process. A trustworthy customs broker not only know the shipping industry, but they know the laws better than anyone and can help you not only meet deadlines, but they can save you the headaches associated with importing. Overall, they help ensure the clean reputation of your business in the eyes of the government and market as well.

If you need a professional help to ensure a fast and hassle-free release of your import goods, contact Excelsior Worldwide Logistics Corp. today at (063) 525-9775 or send an email to wecare@excelsior.ph

The import and export business is still the most lucrative industry anyone could venture into. Aside from the wide range of goods to choose from, playing a critical role as an importer/exporter can help you generate anywhere from a few thousand to millions of dollars monthly in revenue.

While the import/export business may be highly attractive to those who want to start a business with great potentials to generate large revenues, not playing your cards right or making petty mistakes can cause you to lose a great portion of you import/export business, here are six common import/export mistakes to avoid at all costs:

In this post, we will walk you through the steps by step guide on how to release your imported shipments from the Philippine Bureau of Customs (BoC)

Step 1: For new company or individual who wants to import any commodities with commercial value and or in commercial quantity, you first need an Import Clearance Certificate from the Bureau of Internal Revenue. Then you need to apply for Importer’s Accreditation to the Bureau of Customs. Only accredited importers have the privileges to imports any commodities whether regulated imported commodities or freely imported commodities.

Step 2: Import documents required for shipments to the Philippines include:

1. Commercial invoice/Pro-Forma invoice

2. Bill of lading (for sea freight) or air waybill (for air freight)

3. Packing list – A document that details the merchandise in the shipment, along with information on how it was packed, how the items are numbered, the serial numbers, and the weight and dimensions of each item.

4. Applicable special certificates/import clearance/permit depending on the nature of goods being shipped and/or requested by the importer/bank/letter of credit clause, e.g., Food and Drug Administration (FDA) license; and

5. Commercial Invoice of Returned Philippine Goods and/or Supplemental Declaration on Valuation.

6. For a Letter of Credit (L/C) transaction, a duly accomplished L/C, including a Pro-Forma Invoice and Import Entry Declaration for Advance Customs Import Duty (ACID) is required. A Pro-Forma Invoice is required for non-L/C transactions (e.g., Draft Documents against Acceptance (D/A), Documents against Payment (D/P), Open Account (OA) or self-funded documentation).

7. Additional documents for certain imports – Importers bringing in animals, plants, foodstuff, medicine or chemicals must additionally obtain a Certificate of Product Registration from the Philippines’ Food and Drug Administration.

Step 3: File an Entry

Entry must be filed in the Customhouse within 30 days from the date of discharge of the last package from the vessel, which shall not be extendible. Failure to file the entry constitutes implied abandonment and will result in the ‘ipso facto’ forfeiture of the goods/shipment.

You or your customs broker may have the software to file Bill of Entry at office or home. If you do not have such facility, you can approach private EDI (Electronic Data Information) service providers who can arrange to submit the data on behalf of you.

Step 4: Payment of Duties and Taxes for ATRIG

Step 5: Release of Cargo

Upon satisfying all these requirements of, you can now retrieve your import goods from the Customs.

The import customs clearance procedure in the Philippines can be very lengthy and tedious, especially for those small and medium businesses. If you need a professional help to ensure a fast and hassle-free release of your import goods, contact Excelsior Worldwide Logistics Corp. today at (063) 525-9775 or send an email to wecare@excelsior.ph