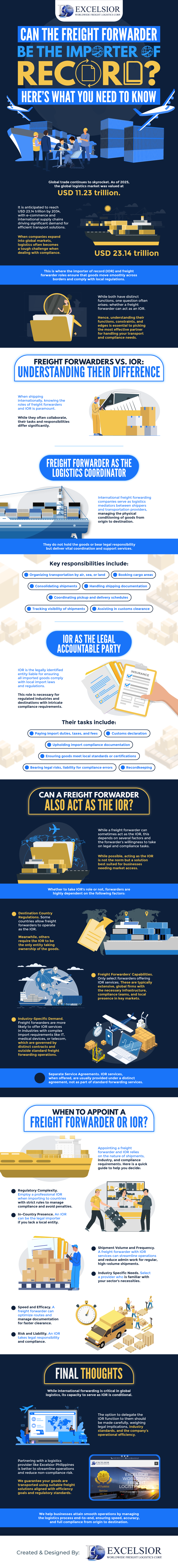

Can the Freight Forwarder Be the Importer of Record? Here’s What You Need to Know

Global trade continues to skyrocket. As of 2025, the global logistics market was valued at USD 11.23 trillion. It is anticipated to reach USD 23.14 trillion by 2034, with e-commerce and international supply chains driving significant demand for efficient transport solutions.

When companies expand into global markets, logistics often becomes a tough challenge when dealing with compliance. This is where the importer of record (IOR) and freight forwarder roles ensure that goods move smoothly across borders and comply with local regulations.

While both have distinct functions, one question often arises: whether a freight forwarder can act as an IOR. Hence, understanding their functions, constraints, and edges is essential to picking the most effective partner for handling your transport and compliance needs.

Freight Forwarders vs. IOR: Understanding Their Difference

When shipping internationally, knowing the roles of freight forwarders and IOR is paramount. While they often collaborate, their tasks and responsibilities differ significantly.

Freight Forwarder as the Logistics Coordinator

International freight forwarding companies serve as logistics mediators between shippers and transportation providers, managing the physical conditioning of goods from origin to destination. They do not hold the goods or bear legal responsibility but deliver vital coordination and support services.

Key responsibilities include:

- Organizing transportation by air, sea, or land

- Booking cargo areas

- Consolidating shipments

- Handling shipping documentation

- Coordinating pickup and delivery schedules

- Tracking visibility of shipments

- Assisting in customs clearance

IOR as the Legal Accountable Party

IOR is the legally identified entity liable for ensuring all imported goods comply with local import laws and regulations. This role is necessary for regulated industries and destinations with intricate compliance requirements.

Their tasks include:

- Paying import duties, taxes, and fees

- Customs declaration

- Upholding import compliance documentation

- Ensuring goods meet local standards or certifications

- Bearing legal risks, liability for compliance errors

- Recordkeeping

Can a Freight Forwarder Also Act as the IOR?

While a freight forwarder can sometimes act as the IOR, this depends on several factors and the forwarder’s willingness to take on legal and compliance tasks. While possible, acting as the IOR is not the norm but a solution best suited for businesses needing market access.

Whether to take IOR’s role or not, forwarders are highly dependent on the following factors:

- Destination Country Regulations. Some countries allow freight forwarders to operate as the IOR. Meanwhile, others require the IOR to be the only entity taking ownership of the goods.

- Freight Forwarders’ Capabilities. Only select forwarders offering IOR services. These are typically extensive, global firms with the necessary infrastructure, compliance teams, and local presence in key markets.

- Industry-Specific Demand. Freight forwarders are more likely to offer IOR services in industries with complex import requirements like IT, medical devices, or telecom, which are governed by distinct contracts and outside standard freight forwarding operations.

- Separate Service Agreements. IOR services, when offered, are usually provided under a distinct agreement, not as part of standard forwarding services.

When to Appoint a Freight Forwarder or IOR?

Appointing a freight forwarder and IOR relies on the nature of shipments, industry, and compliance requirements. Here is a quick guide to help you decide:

- Regulatory Complexity. Employ a professional IOR when importing to countries with strict rules to manage compliance and avoid penalties.

- In–Country Presence. An IOR can be the legal importer if you lack a local entity.

- Shipment Volume and Frequency. A freight forwarder with IOR services can streamline operations and reduce admin work for regular, high-volume shipments.

- Industry Specific Needs. Select a provider who is familiar with your sector’s necessities.

- Speed and Efficacy. A freight forwarder can optimize routes and manage documentation for faster clearance.

- Risk and Liability. An IOR takes legal responsibility and compliance.

Final Thoughts

While international forwarding is critical in global logistics, its capacity to serve as IOR is conditional. The option to delegate the IOR function to them should be made carefully, weighing legal implications, industry standards, and the company’s operational efficiency. Partnering with a logistics provider like Excelsior Philippines is better to streamline operations and reduce non-compliance risk. We guarantee your goods are transported using suitable freight solutions aligned with efficiency goals and regulatory standards. We help businesses attain smooth operations by managing the logistics process end-to-end, ensuring speed, accuracy, and full compliance from origin to destination.