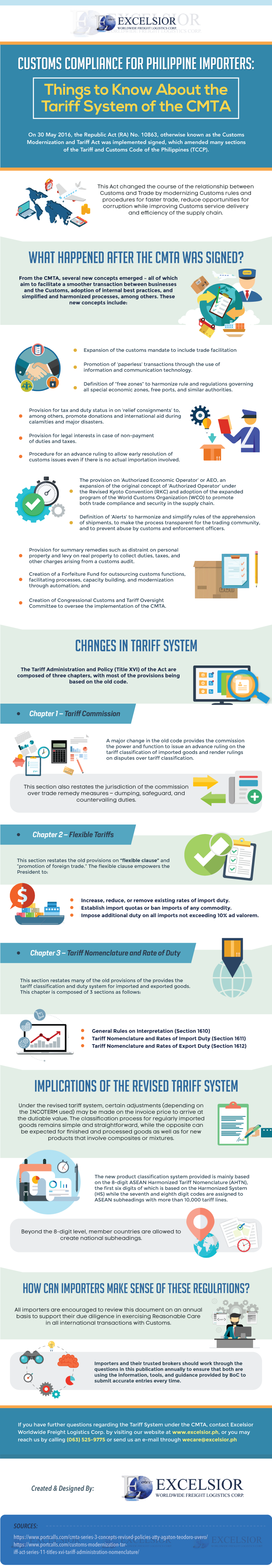

Customs Compliance for Philippine Importers: Things to Know About the Tariff System of the CMTA (Infographic)

On 30 May 2016, the Republic Act (RA) No. 10863, otherwise known as the Customs Modernization and Tariff Act was implemented signed, which amended many sections of the Tariff and Customs Code of the Philippines (TCCP).

This Act changed the course of the relationship between Customs and Trade by modernizing Customs rules and procedures for faster trade, reduce opportunities for corruption while improving Customs service delivery and efficiency of the supply chain.

What Happened After the CMTA Was Signed?

From the CMTA, several new concepts emerged – all of which aim to facilitate a smoother transaction between businesses and the Customs, adoption of internal best practices, and simplified and harmonized processes, among others. These new concepts include:

- Expansion of the customs mandate to include trade facilitation

- Promotion of ‘paperless’ transactions through the use of information and communication technology.

- Definition of “free zones” to harmonize rule and regulations governing all special economic zones, free ports, and similar authorities.

- Provision for tax and duty status in on ‘relief consignments’ to, among others, promote donations and international aid during calamities and major disasters.

- Provision for legal interests in case of non-payment of duties and taxes.

- Procedure for an advance ruling to allow early resolution of customs issues even if there is no actual importation involved.

- The provision on ‘Authorized Economic Operator’ or AEO, an expansion of the original concept of ‘Authorized Operator’ under the Revised Kyoto Convention (RKC) and adoption of the expanded program of the World Customs Organization (WCO) to promote both trade compliance and security in the supply chain.

- Definition of ‘Alerts’ to harmonize and simplify rules of the apprehension of shipments, to make the process transparent for the trading community, and to prevent abuse by customs and enforcement officers.

- Provision for summary remedies such as distraint on personal property and levy on real property to collect duties, taxes, and other charges arising from a customs audit.

- Creation of a Forfeiture Fund for outsourcing customs functions, facilitating processes, capacity building, and modernization through automation; and

- Creation of Congressional Customs and Tariff Oversight Committee to oversee the implementation of the CMTA.

Changes in Tariff System

The Tariff Administration and Policy (Title XVI) of the Act are composed of three chapters, with most of the provisions being based on the old code.

- Chapter 1 – Tariff Commission

A major change in the old code provides the commission the power and function to issue an advance ruling on the tariff classification of imported goods and render rulings on disputes over tariff classification. This section also restates the jurisdiction of the commission over trade remedy measures – dumping, safeguard, and countervailing duties.

- Chapter 2 – Flexible Tariffs

This section restates the old provisions on “flexible clause” and “promotion of foreign trade.” The flexible clause empowers the President to:

- Increase, reduce, or remove existing rates of import duty.

- Establish import quotas or ban imports of any commodity.

- Impose additional duty on all imports not exceeding 10% ad valorem.

- Chapter 3 Tariff Nomenclature and Rate of Duty

This section restates many of the old provisions of the provides the tariff classification and duty system for imported and exported goods. This chapter is composed of 3 sections as follows:

- General Rules on Interpretation (Section 1610)

- Tariff Nomenclature and Rates of Import Duty (Section 1611)

- Tariff Nomenclature and Rates of Export Duty (Section 1612)

Implications of the Revised Tariff System

Under the revised tariff system, certain adjustments (depending on the INCOTERM used) may be made on the invoice price to arrive at the dutiable value. The classification process for regularly imported goods remains simple and straightforward, while the opposite can be expected for finished and processed goods as well as for new products that involve composites or mixtures.

The new product classification system provided is mainly based on the 8-digit ASEAN Harmonized Tariff Nomenclature (AHTN), the first six digits of which is based on the Harmonized System (HS) while the seventh and eighth digit codes are assigned to ASEAN subheadings with more than 10,000 tariff lines. Beyond the 8-digit level, member countries are allowed to create national subheadings.

How can Importers Make Sense of These Regulations?

All importers are encouraged to review this document on an annual basis to support their due diligence in exercising Reasonable Care in all international transactions with Customs. Importers and their trusted brokers should work through the questions in this publication annually to ensure that both are using the information, tools, and guidance provided by BoC to submit accurate entries every time.

If you have further questions regarding the Tariff System under the CMTA, contact Excelsior Worldwide Freight Logistics Corp. by visiting our website at www.excelsior.ph, or you may reach us by calling (063) 525-9775 or send us an e-mail through wecare@excelsior.ph

Excelsior Worldwide conduct free orientation for those who are willing to learn about importation & exportation. It is our advocacy to share our knowledge & experienced for 17 yrs. in the business.