5 Steps To Save When Importing From China

In 2017, China replaced Japan as the top bilateral trading partner of the Philippines with a 20.7% increase in imports from 2010.

This 2018, the imports shoot up to 51.2%, which is more than twice as it was last year. The said imports include electronics and machinery, mineral fuels, iron and steel, plastics, vehicles, ceramic products, furniture and lighting, and paper among others. No wonder why many businesses, whether big or small, import from China. If you’re one of them, here are five steps to help you reduce your expenses:

Plan ahead of time

China is 3,096 kilometers away from the Philippines, which means that the importation of your goods will likely take five days or more, depending on the mode of transportation. Although you can request for faster transportation, you will be asked to pay for a rush fee.

If you want your goods to arrive on-time without the extra charges, it’s better to plan it in advance. Moreover, it will also give you more time to find a local freight forwarder that will assist you throughout the importation procedure.

Find a local freight forwarder

Most freight forwarders in the Philippines are affiliated with numerous international transport organizations and companies worldwide, including local Chinese logistic companies. Hence, you should choose a freight forwarder that can and will use its connections to negotiate for better prices on your behalf.

Furthermore, your chosen freight forwarder should also be knowledgeable about the freight peak seasons in China (e.g., Chinese New Year) because during peak seasons, importing can become complicated due to high demand, high prices, and a probability of container shortage.

If this is a no-brainer for your local freight forwarder, you’re in the right hands. Knowing the peak seasons beforehand will help you save by importing non-urgent goods during regular seasons and avoid struggling to find a container spot during peak seasons.

Choose a suitable transportation method

You can import either by sea or by air. Sea freight is ideal for large shipments that aren’t urgently needed. On the other hand, air freight is suitable for smaller and lighter shipments that are time-sensitive.

Importing by air is more expensive than importing by sea because it’s faster and more secure. It goes through fewer hands, therefore minimizing the risk of damages and theft. To cut back on expenses, use air freight only if its necessary.

Another option that you could try is splitting your shipments. For instance, if you have one hundred boxes of imports wherein thirty boxes need to be delivered immediately, and the other seventy aren’t, consider putting the thirty on a plane and the rest on a cargo ship.

Although split shipments might seem inconvenient because it involves preparing two invoices, packing lists and handling charges among others, once you already have a local freight forwarder, it will be hassle-free because they will assist you in accomplishing the necessary paperwork.

A friendly tip: When importing by air, it is best to book six to seven days in advance of the Cargo Ready Date (CRD) while when importing by sea, consider booking three to four weeks ahead of the CRD.

Ensure proper product packaging and insurance

Proper packaging reduces the risk of product damage and loss while in transit (especially fragile and perishable products), whereas cargo insurances can be converted into cash claims in case of damage and loss.

Although the proper packaging and cargo insurances might seem more like spending than saving, neglecting them will cost you a fortune in case your goods get damaged or lost. Better safe than sorry, right?

Obtain rates with the lowest GRI (General Rate Increase) possible

General Rate Increase is the adjustment of container shipping rates and is only applicable when importing by sea.

General Rate Increase and demand are directly correlated. When the demand is high, the GRI also goes up and vice versa, which means that GRIs go up during peak seasons.

The good news is, if you followed the first four steps mentioned earlier, especially planning ahead of time, you will be able to choose between multiple ocean freight rates and obtain the lowest GRI even during a peak season because as the saying goes ‘the early bird catches the worm.’

These five steps only prove that there are always ways to save when you are determined to look for them.

Here at Excelsior Worldwide Freight Logistics, we have equipped people who are knowledgeable regarding import procedures and are committed to reducing your expenditures as much as you are.

We also conduct free orientation for those who are willing to learn about importation & exportation. It is our advocacy to share our knowledge & experience for 17 years in the business.

Contact us today at (063) 525-9775 or email us at wecare@excelsior.ph

Sources:

- http://www.worldsrichestcountries.com/top_philippines_imports.html

- https://cargofromchina.com/save-freight-cost/

- https://www.icontainers.com/us/2016/03/09/tips-for-importing-from-china/

- https://www.freightos.com/freight-resources/beating-peak-season-blues-shipping-freights-busiest-season/

- https://www.flexport.com/help/323-peak-season-shipping-tips

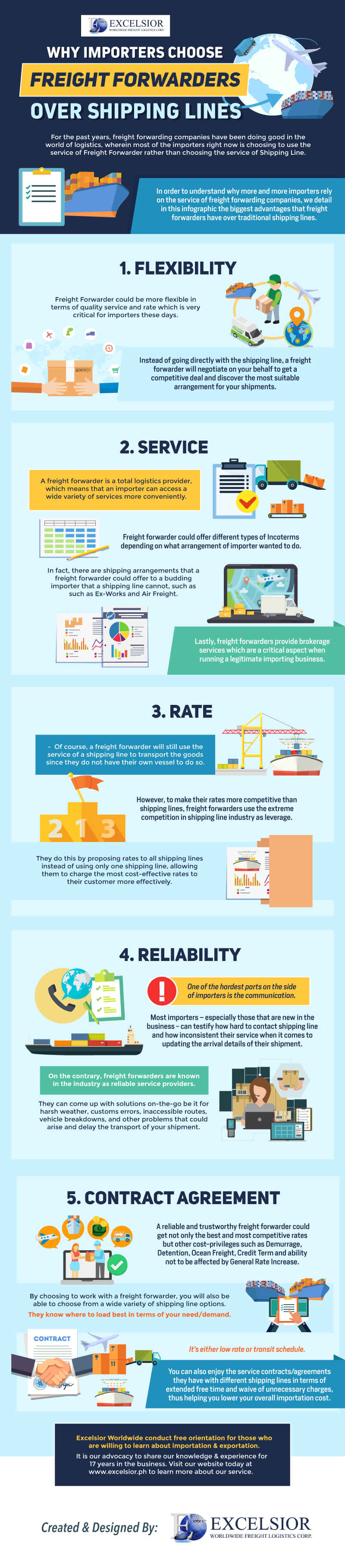

1. Flexibility

1. Flexibility