5 Questions to Ask Before You Hire a Freight Forwarder (Infographic)

A reliable and trustworthy international freight forwarding company is crucial to the success of any import/export business operations. Regardless of the size of your company, this aspect could mean make or break your business.

Make sure to ask these five questions before you entrust your cargo in someone else’s hands.

1. Are You Trustworthy?

First, you need to choose a company that puts integrity at the core of their business. A freight forwarding company acting in integrity means that they are not driven by a desire to earn huge profits, get in on trends, and other external mechanisms. Instead, they sincerely value the trust their customers put in them, and in the result, they become the “go-to company” in their respective niche.

A trustworthy company is also one that is a member of a reputable associated and has accreditations which embody their legitimacy and reliability.

Excelsior upholds utmost integrity in their customer service, business dealings, and business operations. They are duly accredited as Total Logistics Company by the Bureau of Customs and have strong affiliations with key authorities and logistics organizations in the country.

2. Do You Provide the Shipping Service I Need?

It’s important to make sure that the freight forwarder you intend to hire provides the freight service that you need. Do they have the mode of transport necessary to transport the volume of cargo you want to ship? Do they provide port to port, port to door, door to port, or door to door services?

3. Do You Have Strong Experience in the Field?

Freight forwarding companies have sprouted like mushrooms in the recent time, so it is only imperative to choose one that has a reputation that has been built accordingly through the years. A good freight forwarder should indicate the number of years they have been in operation, as some of the companies they have managed to provide service with.

As well as checking how long your chosen freight forwarder has been in business, it’s also worth checking how much experience they have that’s relevant to the cargo you wish to ship. Excelsior has been in service for the past 17 years and continues to be the trusted freight forwarder of a plethora of different businesses in the Philippines these days.

4. Is Your Rate Cheaper Than Shipping Line?

Perhaps the most cited reason why most businesses use a freight forwarder is that they offer cheaper rates than shipping lines. They do this by proposing rates to multiple shipping lines, giving cost advantage which they subsequently pass to their clients. Therefore, it only makes sense to choose one that charges less compared to what shipping lines offer. This is crucial if you want to save money on your import/export cost effectively.

5. Do You Cater Brokerage Services and Provide Own Trucking Services?

Probably, you are looking for a freight forwarder because you want to simplify the complicated process of moving your goods across borders. As such, it is more practical and cost-effective to choose a freight forwarder who is also capable of meeting your customs brokerage and trucking services needs.

By doing so, you will only have to deal with one company with regards to brokerage documentation, and that all your cargos will be managed consistently from the point of origin to the point of destination.

Excelsior Worldwide Freight Logistics conduct free orientation for those who are willing to learn about importation & exportation. It is our advocacy to share our knowledge & experience for 17 years in the business. Visit our website today at www.excelsior.ph to learn more about our service.

Sources:

https://issuu.com/virgill.ratliff/docs/tips_on_picking_the_best_internatio

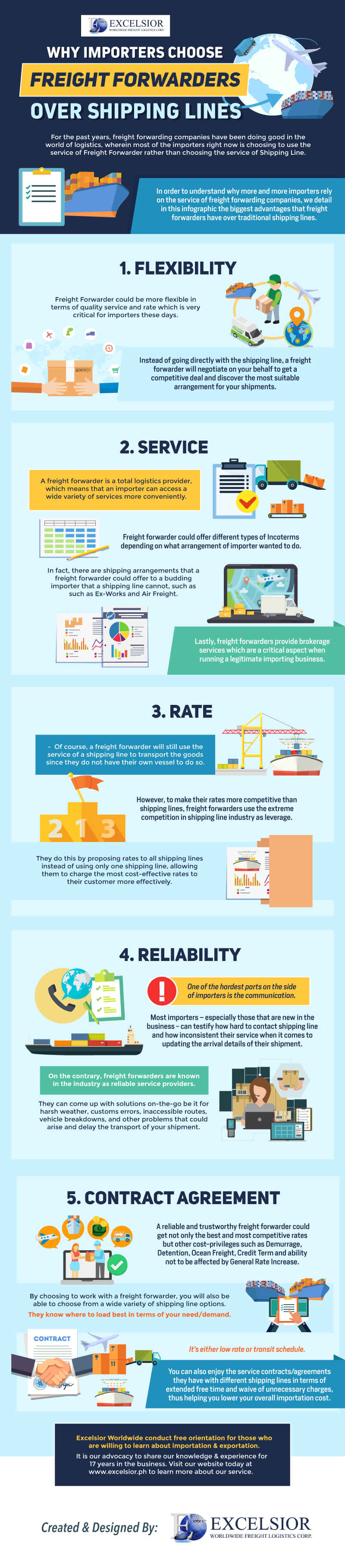

1. Flexibility

1. Flexibility