Ways of Preventing Shipment Delays

Untimely arrival of shipment is perhaps one of the most common problems of businesses nowadays. With the world currently facing the COVID-19 outbreak, supplies can deplete faster, and delayed shipments could result in poor customer service and wasted profit opportunities.

On the other hand, those who specialize in manufacturing are more likely to suffer from the effects of delayed shipment. Based on a study, around 62% of respondents believed that they are less likely to negotiate again with a supplier whose products were not delivered to them within the promised dates.

If you’re running an import/export business trying to transport your products with minimal to no delays, then here are some of the ways to do so.

Know the Cause of the Delay

The first step for preventing delayed shipment is through having an understanding of what causes the delay in the first place. This will enable you to prepare solutions the next time around.

Examples of scenario that are usually attributed to the untimely arrival of shipment include:

- Bad Weather – Typhoons and even other forms of natural calamities are purely unavoidable, which make it the most tolerable cause of shipment delays.

- Errors in Documentation – Any errors in documentation, such as the misspelling of the address, incorrect order forms, and incomplete information, can also lead to unnecessary late deliveries.

- Package Redirection – A change in information, especially the address, can usually make a shipment be transferred in a different time of arrival.

- Customs Delay – Customs authorities typically require a list of requirements before you can clear your shipment. Failure to submit these documents in time will guarantee a late shipment.

Practicing utmost care and planning ahead of time are the best measures that you can do to prevent any of these indicators from happening.

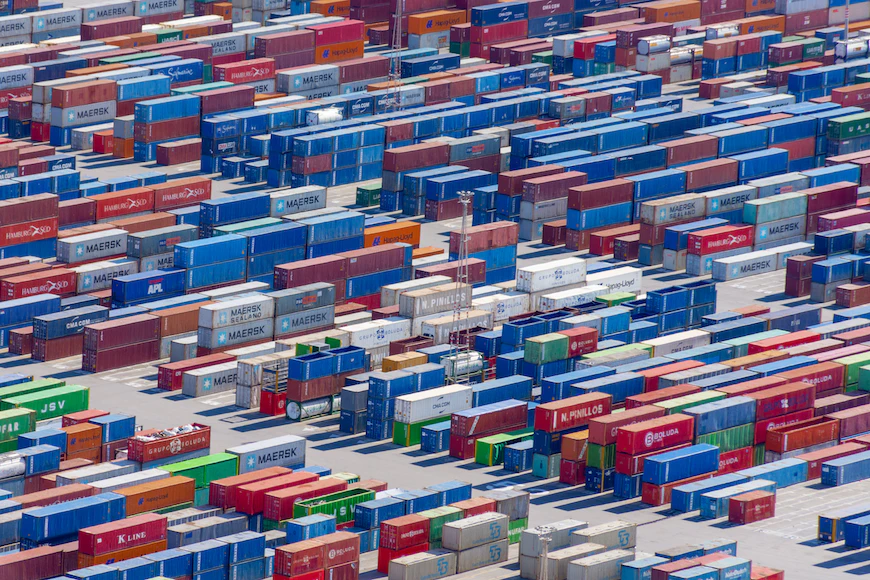

Make your Warehouse More Organized

Keep your warehouse well-organized, especially if you receive tons of orders every day. Arrange your products based on how popular they are, and make sure that the packages that you will transfer are all in a separate place so that they can be easier to find upon dispatching.

Utilize Logistics Software

Automation can be considered as one of the efficient ways of combating delayed shipment. However, you should take note that using software for managing logistics can prompt you to invest more money, as they can be quite expensive. But in case you don’t have enough resources to afford logistics software, you can still go for an alternative way. Formulate a step-by-step checklist that will guide your employees while doing logistics tasks.

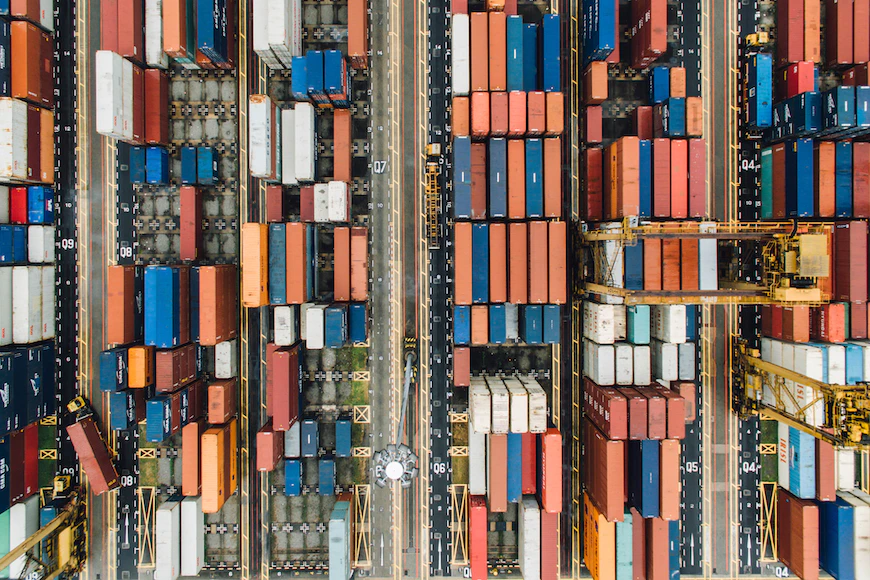

Hire a Freight Forwarder or Customs Broker

Partnering with a freight forwarding agency or a customs broker in the Philippines comes with a lot of benefits, which include preventing any delays in your shipment. Since both professions are very knowledgeable in logistics, they can provide you some helpful advice of the best carrier company that will ensure the timely arrival of your goods. And if you have issues with your documents, a customs broker will surely help you clear everything up as they are very familiar with the process involving customs requirements.

If you want to know more about what freight forwarders and customs brokers do, check out the infographic here.

Excelsior Worldwide Freight Logistics conducts free orientation for those who are willing to learn. It is our advocacy to share our knowledge & experience worth more than a decade in the business. Visit our website today at www.excelsior.ph to learn more about our service.