Why You Need a Licensed Customs Broker in the Philippines

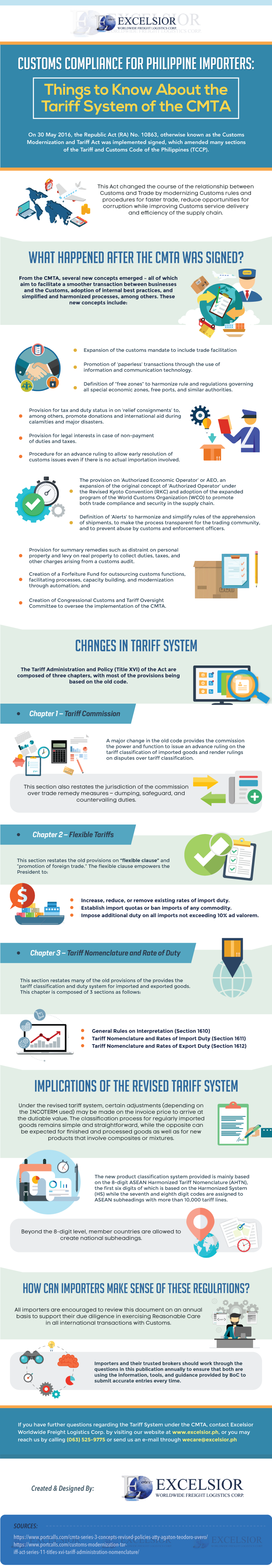

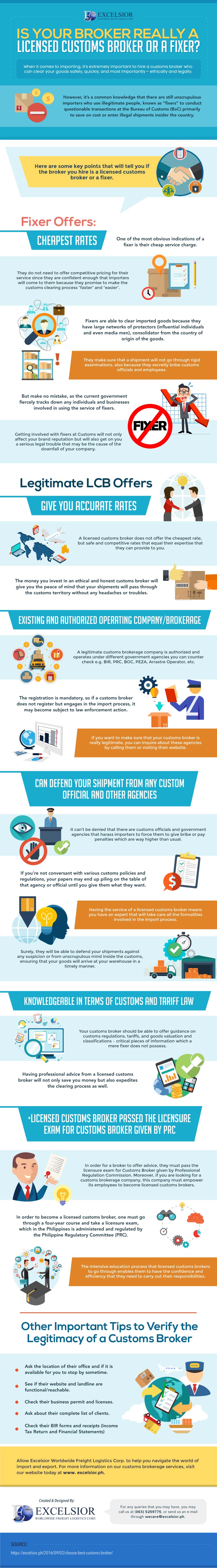

Commercial businesses in the Philippines, especially those that specialize in importing and exporting, are always facing challenges that are often involved with shipping and customs processes. Transporting products in and out of the country requires an enterprise to comply with specific rules and regulations that can be complex and time-consuming. This became the reason why customs brokerage has become an ever-growing business trend as hiring a licensed customs broker can save a business owner from getting worried about preparing the necessary documents.

Are you planning to run an import/export business in the country? Then you better know more about how customs brokers and why you need to hire one:

Reason #1: To Establish Effective Communication with the Government Authorities

Dealing with government authorities to ship your products can be a tedious process that requires technical knowledge in the existing laws and regulations. For your shipment to be released by Philippine Customs and other government bodies, you will have to submit a number of documents and fill-out forms. Failure to effectively communicate while complying with such requirements can result in wrong shipment information and further delay in your supply chain.

Customs brokers can get rid of this problem because they are well-connected with those in authority, speeding up the clearing process and avoid any problems usually associated with customs requirements.

Reason #2: To Help You Focus More on Other Areas of Your Business

With a trusted customs broker taking care of your shipment tasks that you were supposed to do, you will find yourself in a more convenient situation. More time means more opportunity for addressing other important areas of your business, such as managing your employees, daily operations, etc.

Reason #3: To Prevent Unnecessary Expenses

There are some businesses today who gets fallen on the trap of clearing shipments themselves because they thought that it would save them more money. This is a clear misconception because the rules and regulations in cross-border transactions can fluctuate at any given moment, making it easy for know-it-all companies to experience delays, and others unwittingly commit violations that could prompt them to spend more money in the long run.

Reason #4: To Save Time and Effort

Time, as a precious resource for an import/export business. Depending on the nature of your products, ensuring that it will arrive at its destination on time is a must. Customs brokers in the Philippines are trained and skilled enough to work in a way that can optimize the flow of your overall supply chain, especially in the aspect of product shipping.

Reason #5: To Help You Find the Best Option for Shipping

A customs broker can serve as a guide for your shipping options. By considering several factors, customs brokers can recommend the best carrier, be it via air, ocean freight, or truck freight.

Excelsior Worldwide Freight Logistics conducts free orientation for those who are willing to learn. It is our advocacy to share our knowledge & experience worth more than a decade in the business. Visit our website today at www.excelsior.ph to learn more about our service.