How to Release Your Cargo in Customs Without Delay

In our previous post, we’ve discussed the process of clearing your imported goods from the Philippine Customs.

While nobody enjoys getting their freight shipments suspended by customs, it can also result in frustrating and costly delays, especially if the goods awaiting customs clearance are meant to be sold at retail. Not only that but with the possibility of some rather sharp penalties for non-compliance, it’s crucial to follow correct customs procedure at all costs to ensure no additional costs or charges on your cargo.

With that in mind, now that you know the step by step of customs clearing, it’s time for you to learn the ways to fast-track the release of your consignment once it reached the Philippine soil. Here’s how:

1. Have Specific Description of the Cargo in All Documents

Make sure that all necessary import documents are properly filled-out to avoid any delays of you receiving your cargos in a timely manner. By detailed description, it is good to follow your SKU description. If it is a box of red shirts, size medium, indicate that exactly. This will aid the process if an exam is required.

Moreover, you need to mark your goods legibly and conspicuously with the country of origin unless exempted. Exemptions usually apply to goods that cannot be individually marked, like tiny items, such as screws. You should, however, mark the sale packaging of these types of items.

At the bottom of customs invoice, including any markings on the packages, and add a notify party, such as your customs broker.

2. Be Ready for the Import Permit (if necessary)

If you’re an accredited importer, the Bureau of Customs will grant you a special permit in the form of a document which you may need to present during the customs clearing process if you’re a first-time importer. Prepare this, along with other necessary documents to prove that you’re a legitimate importer in the Philippines and to avoid possible legal troubles.

3. Provide Proof of Payment

All goods coming from a foreign country needs to be declared, such as their description, quantity, and their value which will be the basis for assessment of duties and taxes. After the right duties and taxes are paid and registered by the customs authority, you will be provided with a proof of payment which you also need to provide during the customs clearing process.

4. Hire Trustworthy Brokerage Company

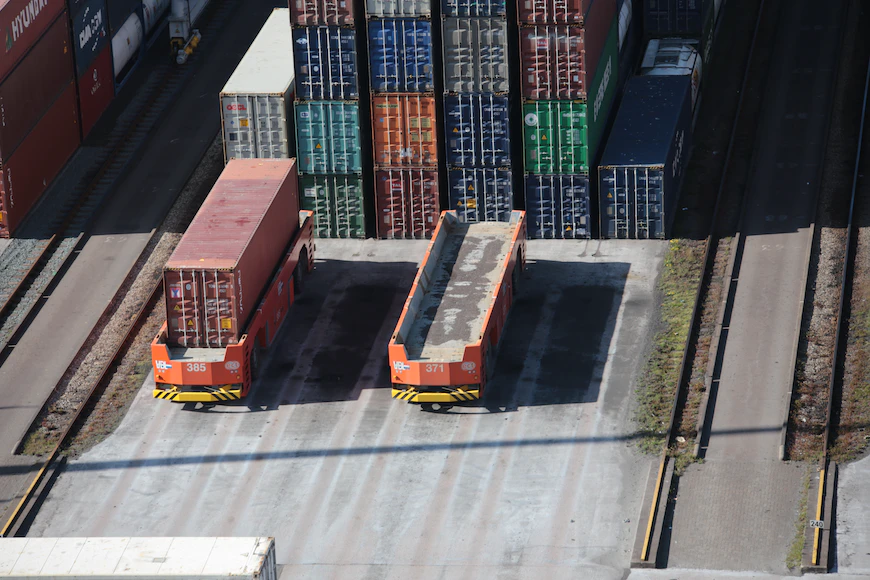

Having the wrong person handle your customs brokerage can be very problematic. Shipping containers are warehoused as they go through customs clearance. Warehousing and storage fees can add up quickly. If there is a problem with your customs brokerage and your customs clearance does not happen smoothly, your shipping costs could go up by hundreds to thousands of dollars.

By a hiring legitimate and trustworthy brokerage company, you will be able to experience many advantages – one of such is faster customs clearing process. A trustworthy customs broker not only know the shipping industry, but they know the laws better than anyone and can help you not only meet deadlines, but they can save you the headaches associated with importing. Overall, they help ensure the clean reputation of your business in the eyes of the government and market as well.

If you need a professional help to ensure a fast and hassle-free release of your import goods, contact Excelsior Worldwide Logistics Corp. today at (063) 525-9775 or send an email to wecare@excelsior.ph